Last week, the Economic Policy Institute, a nonpartisan thinktank, released a report on the increasing pay gap between chief executives and workers. This research tells a familiar story with updated figures. When taking into account stocks, which now make up more than 80% of the average CEO’s compensation package, the report found that chief-executive pay has risen by an astounding 1,322% since 1978. That’s more than six times more than the top 0.1% of wage earners and more than 73 times higher than the growth of the typical worker’s pay, which grew by only 18% in the same time period. Most remarkable, however, is the 18.9% increase in CEO compensation between 2019 and 2020 alone.

CEO compensation outpacing that of the 0.1% is a clear indication that this growth is not the product of a competitive race for skills or increased productivity, the EPI report explains, so much as the “power of CEOs to extract concessions. Consequently, if CEOs earned less or were taxed more, there would be no adverse impact on the economy’s output or on employment,” the report concludes.

This report joins a slew of data sounding an alarm on a massive upward transfer of wealth to the top 1% over the course of the pandemic. One estimate by the Institute for Policy Studies puts this figure as high as $4tn, or a 54% increase in fortunes for the world’s 2,365 billionaires.

Today in the US, the CEO-to-worker pay gap stands at a staggering 351 to one, an unacceptable increase from 15 to one in 1965. In other words, the average CEO makes nearly nine times what the average person will earn over a lifetime in just one year.

It’s worth remembering that the federal minimum wage would be $24 an hour today had it kept pace with worker productivity, rather than $7.25, where it’s been stuck since 2009. Additionally, inflation has resulted in a nearly 2% pay cut over the past year despite modest gains in hourly wages, according to the Bureau of Labor Statistics.

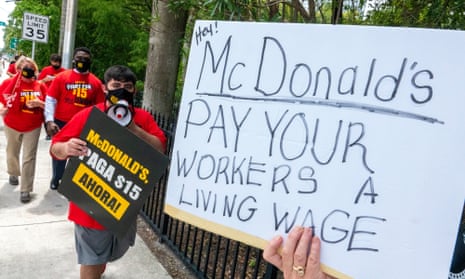

This reality is unfolding against a narrative of a “labor shortage,” with small businesses, retail giants and fast-food chains expressing difficulty in filling poorly paid positions – even though there are one million more unemployed workers than there are open jobs. Clearly, something else is going on here.

The grim reality is that a huge section of the American labor force – between 25% and 40% – made more on unemployment than they ever have working full-time at a minimum wage job. $7.25 an hour is $290 a week before taxes, compared with the $300 in weekly federal benefits that pandemic unemployment assistance provided. Nor does this account for the additional weekly state benefits that those on unemployment received.

In our current milieu, “labor shortage” has become doublespeak for a stubborn reluctance on the part of politicians and businesses to address poverty wages, the remedy for which has been to let pandemic unemployment assistance expire so that workers are desperate enough to go back to the exploitative conditions that billion-dollar companies insist are necessary to keep the economy running.

Rather than succumb to mainstream accounts that our “labor shortage” is the consequence of welfare-induced idleness, we should have an honest discussion about how we’ve allowed the essential workers who uphold our standard of living to be abused for so long while the mega-wealthy billionaires whom they work for realize their infantile fantasies of starting colonies in space.

The EPI is correct. A wealth tax on the 1% would not hinder the economy nor employment, so much as rein in the excesses of the billionaire space race and luxury doomsday bunkers that stand in stark relief to the floods, fires, famine and pestilence that have currently taken hold.

Among the report’s policy recommendations for reversing skyrocketing pay for CEOs are raising the marginal tax rate on the ultra rich to “limit rent-seeking behavior” and penalizing companies with unacceptable CEO-to-worker pay ratios with higher corporate taxes. Let’s examine the feasibility of both under Joe Biden’s administration.

When Biden came into office, Trump had cut corporate tax rates from 35% to 21% and lowered rates on the ultra-wealthy to such an extent that the richest 400 people in the US paid a lower tax rate than any other group in the country – including the minimum wage workers who are rightly refusing to return to the same conditions they withstood before the pandemic. Investopedia called Trump’s Tax Cuts and Jobs Act the “largest overhaul of the tax code in three decades”.

Biden, seeking to undo some of this pillaging of the public sphere, has proposed raising corporate taxes to 28% – 7% lower than what they had been when Barack Obama left office – and raising the top rates for individuals back to 39.6% from Trump’s 37% as part of the Democrats’ $3.5tn budget proposal (though there was some suggestion that Biden would concede to a 25% corporate tax rate if it would please congressional Republicans). Biden has also stated that he will not increase taxes on those making less than $400,000 – meaning less than the top 2% of wage earners.

In other words, popular slogans taking aim at the top 1% have resulted in an administration of corporate Democrats that will attempt to take aim at the 1%, but make clear to their base that the 1% is as far as they’re willing to go.

This is a far cry from the popular policies Bernie Sanders proposed during the presidential primaries, such as giving workers an ownership stake in the companies they’re employed by, democratizing corporate boards through employee elections, passing a wealth tax, banning stock buybacks and more. And it falls short of what is by far the cheapest and easiest solution to stimulating the economy and vastly reducing income inequality while steering clear of Republican interference: full student debt cancellation through executive order.

With the stroke of a pen, Biden could provide life-changing financial relief for one in eight people living in the US. Each day he chooses not to is further proof that Biden is keeping to his original promise to rich donors on the campaign trail: “… nobody has to be punished. No one’s standard of living will change, nothing would fundamentally change.”

Indigo Olivier is an investigative reporting fellow at In These Times magazine